Building a Resilient Automotive Supply Chain

Explore the modern automotive supply chain, from global complexities and EV shifts to practical strategies for building resilience and...

The automotive supply chain is the sprawling, global network of companies, people, and processes that work together to build a vehicle and get it into the customer's hands. It’s a massive undertaking that covers everything from mining raw materials to delivering aftermarket parts.

What is the Automotive Supply Chain

Think of it like a global symphony. Thousands of individual players—suppliers, manufacturers, logistics providers—must all perform their part in perfect harmony to produce a single finished vehicle. This isn't a simple A-to-B production line; it's an intricate web of relationships and dependencies.

The modern car is a complex machine, made up of roughly 30,000 individual parts. The core purpose of the supply chain is to get every one of those parts to the right place, at the right time, in the right sequence. It's a monumental feat of coordination that spans continents and involves a constant flow of materials, information, and capital.

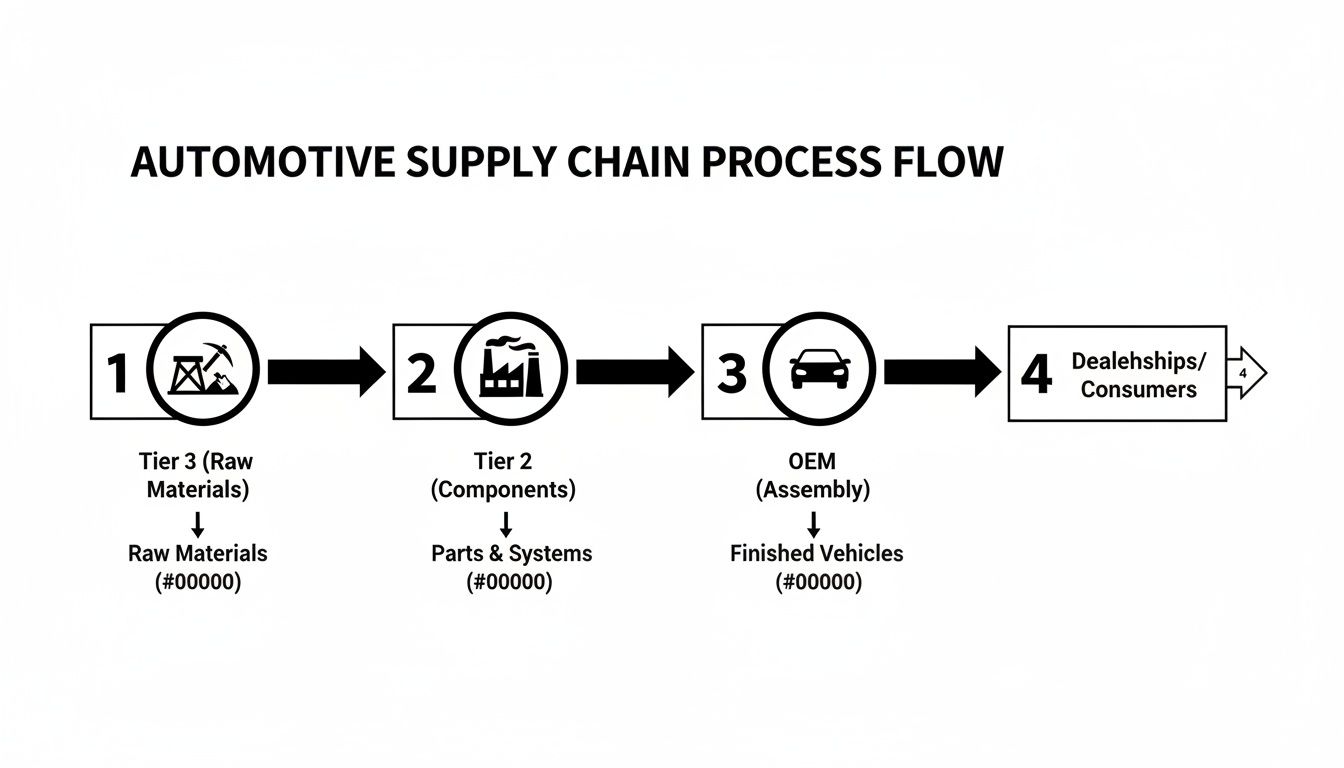

The Key Players and Tiers

The easiest way to make sense of this complexity is to think of it as a tiered system. At the very top, you have the Original Equipment Manufacturer (OEM)—the big brand names like Ford, Toyota, or BMW. Everyone else in the chain is organized by their relationship to the OEM.

Tier 1 Suppliers: These are the direct suppliers to the OEMs. They aren't just shipping bolts; they’re delivering complex, pre-assembled modules like complete seating systems, transmissions, or infotainment dashboards. For a deeper look at their critical function, check out our guide on what is a Tier 1 supplier.

Tier 2 Suppliers: These companies supply the parts and components that Tier 1s use to build their modules. A Tier 2 might make the electric motors that go into a power seat system or the specific processors for an engine control unit.

Tier 3 Suppliers: This is the foundational level of the supply chain. Tier 3 suppliers provide the raw or semi-finished materials—think steel, plastic pellets, or textiles—that are used by Tier 2 manufacturers.

A disruption at a single Tier 3 supplier—like a fire at a specialized chemical plant—can send shockwaves up the entire chain, eventually halting an OEM's assembly line thousands of miles away.

The Trade-Off: Efficiency vs. Vulnerability

For decades, the entire automotive industry has been built on the principles of lean manufacturing, specifically Just-in-Time (JIT) and Just-in-Sequence (JIS). The goal of JIT is to eliminate costly inventory by having parts arrive at the factory exactly when they're needed. JIS takes it a step further, delivering parts in the precise order they’ll be installed on the vehicles moving down the assembly line.

These systems are masterpieces of efficiency. They slash warehousing costs and force incredible discipline throughout the supply chain. But there’s a catch. They also create a system with virtually zero buffer. There is no room for error. A small shipping delay, a container held up in customs, or a minor quality issue can bring a multi-billion dollar assembly plant to a grinding halt.

This delicate balance between extreme efficiency and inherent fragility is the central challenge in the industry. Understanding the complex dance of modern automotive logistics is the key to grasping how this high-stakes system holds together.

Tracing a Component's Journey to the Assembly Line

To get a real feel for the automotive supply chain's massive scale and intricate timing, let's stop talking in abstracts and follow a single component from the ground up. We'll trace the path of a wiring harness, which is essentially the vehicle's nervous system—a complex bundle of wires, connectors, and terminals that routes power and data everywhere from the headlights to the infotainment screen.

This journey doesn't start in a clean, high-tech factory. It begins deep in the earth with a Tier 3 supplier, in this case, a mining company that extracts copper ore. This is the absolute foundation of the supply chain, where the raw materials are pulled from the planet.

From Raw Material to Specialized Part

Once that copper is mined and refined, it heads to a Tier 2 supplier. This is where the raw commodity starts to become something more specialized. This manufacturer will draw the copper into miles of thin wire and apply a precise coating of plastic insulation—sourced from yet another Tier 3 supplier—to create automotive-grade electrical cable.

The magic really happens at the Tier 1 supplier. This is where the true complexity comes into focus. Thousands of individual wires in different colors and lengths arrive, along with hundreds of plastic connectors and metal terminals from various other Tier 2 suppliers.

Think of the Tier 1 supplier as the master choreographer. They take all these disparate parts and perform an incredibly detailed sub-assembly process, following a precise schematic to:

- Cut and Strip: Every wire is cut to a specific length, and its ends are carefully stripped.

- Crimp Terminals: Metal terminals get crimped onto the exposed wire ends, creating the connection points.

- Insert into Connectors: These terminals are then pushed into specific cavities within multi-pin plastic connectors.

- Bundle and Protect: Finally, the entire web of wires is bundled together and wrapped in tape or conduit to shield it from engine heat and road vibration.

What started as a pile of simple parts has now become a highly engineered, vehicle-specific wiring harness. Each one is a unique product, built for a particular model and trim level.

This flowchart illustrates how each tier adds another layer of value, turning basic materials into a major automotive component.

As you can see, the process is a progressive build-up, transforming basic elements into sophisticated systems long before they ever get close to a final assembly plant.

The Final Mile to the Assembly Line

The last leg of this journey is where the clock ticks the loudest. The finished wiring harness is shipped from the Tier 1 facility to the OEM’s assembly plant or, more commonly these days, to a nearby third-party logistics (3PL) partner specializing in services like kitting and sequencing.

A modern assembly line doesn't just build one car model. It might produce a sedan, then an SUV, then a pickup truck, each with different features and, therefore, a completely different wiring harness.

A partner handling line-side sequencing gets a direct data feed from the OEM’s production system. This tells them the exact build order for the next few hours. They then pull and arrange the specific harnesses into the precise sequence they'll be needed on the line.

This is Just-in-Sequence (JIS) delivery, and it's absolutely critical. Carts are loaded with harnesses in the exact order they will be installed—harness A for the sedan, B for the SUV, C for the truck—and delivered directly to the workstation, often arriving just minutes before they're needed.

Following this single component from mine to installation puts the immense coordination of the automotive supply chain into sharp relief. Dozens of independent companies have to operate in perfect harmony. A delay in copper mining (Tier 3), a quality problem with a plastic connector (Tier 2), or a logistics mistake in sequencing (3PL) can bring a multi-billion dollar operation to a dead stop. It’s a powerful illustration of why visibility and control at every single step are non-negotiable.

Navigating Today's Toughest Industry Challenges

For decades, the automotive supply chain was a masterclass in efficiency. Concepts like Just-in-Time (JIT) and Just-in-Sequence (JIS) were brilliant—in a predictable world. But that world is gone. Today, the system's finely tuned nature has become its biggest vulnerability.

We're in a perfect storm of geopolitical shakeups, a massive technological pivot to EVs, and logistical nightmares that just won't quit. These aren't abstract risks; they are daily fires that drive up costs, cause delays, and put production goals in jeopardy. The game has changed from pure efficiency to resilient survival.

Geopolitical and Trade Volatility

The ground beneath global trade is constantly shifting. A single policy change can detonate established supply chain maps, inflicting immediate operational and financial pain.

Remember the 25% tariff slapped on certain foreign cars and auto parts? That wasn't a minor tweak; it was an earthquake. Giants like GM and Ford had to scramble, accelerating U.S. production to avoid the financial hit. We saw freight patterns from Canada and Mexico warp almost overnight. It was a stark reminder of how quickly decades-old logistics networks can be broken.

This isn't a one-off issue. Ongoing trade disputes and complex regulations like the Uyghur Forced Labor Prevention Act (UFLPA) create a constant state of uncertainty. The UFLPA, for example, forces companies to prove their supply chains are clean of forced labor—a monumental task when you're dealing with deep, often opaque tiers of suppliers.

The Massive Shift to Electric Vehicles

The industry's pivot to Electric Vehicles (EVs) isn't just a model refresh; it's the biggest operational overhaul in a century. We're not just swapping a fuel tank for a battery pack. We're being forced to build an entirely new automotive supply chain that has to run alongside the old one.

This dual reality is stretching resources to the breaking point. OEMs are now juggling two completely different sourcing playbooks:

- The Old Guard: The traditional network for engines, transmissions, and exhausts.

- The New Frontier: A completely new ecosystem for batteries, electric motors, and power electronics.

The EV side is where the real headaches are. Getting raw materials like lithium, cobalt, and nickel is a global battle. Mining and processing are cornered by just a few countries, leading to wild price swings and geopolitical leverage. We learned a brutal lesson about depending on specialized components during the semiconductor crisis. To avoid making the same mistakes again, it's worth reviewing the lessons from the semiconductor supply chain crisis and applying them to the EV transition.

Persistent Operational Headaches

Beyond the big-picture strategic shifts, the industry is fighting a war of attrition on the ground. These are the day-to-day operational frictions that bleed efficiency and inflate budgets.

Port congestion is still a massive chokepoint. One ship stuck in a queue can trap thousands of critical parts, and the ripple effect can throw production schedules into chaos for weeks. It’s the domino effect playing out in real-time.

Making matters worse are the stubborn labor shortages. Even if parts make it off the ship, a lack of qualified truck drivers means they sit at the port, racking up fees. The same goes for skilled workers in warehouses and on assembly lines—the shortage impacts everything from quality checks to final kitting.

To better understand how these issues intersect, it's helpful to categorize them.

Key Disruptions in the Modern Automotive Supply Chain

The table below breaks down the primary sources of disruption impacting automotive supply chains today, with real-world examples illustrating their impact.

These challenges aren't happening in a vacuum. A trade tariff can worsen a logistical bottleneck, which is then amplified by a labor shortage. Successfully navigating the modern automotive supply chain is no longer just about being lean—it’s about being resilient enough to take a punch.

Building a More Resilient and Cost-Effective Supply Chain

For decades, the automotive supply chain was a marvel of just-in-time efficiency. But that relentless focus on "lean" created a system that was also incredibly brittle. We’ve all seen how easily it can shatter. The goal now has to shift from pure efficiency to genuine resilience—transforming the supply network from a fragile liability into a strategic asset that can absorb shocks without breaking.

It's about building a system that can bend. This means getting ahead of risks before they cripple production, moving from reactive firefighting to strategic fortification.

Diversify and Regionalize Your Supplier Base

Relying too heavily on a single supplier or one geographic region is one of the biggest self-inflicted wounds in supply chain management. A fire, a flood, or a political flare-up in one small corner of the world can bring an entire global operation to its knees. The antidote is intentional diversification.

This isn’t about ditching trusted partners. It's about cultivating a portfolio of sources. When you qualify alternative suppliers in different regions, you're building in redundancy—an essential safety net.

A powerful strategy here is nearshoring. Moving a source from Asia to Mexico, for example, does more than just shorten the trip. It drastically cuts lead times, sidesteps trans-Pacific port jams, and insulates your operations from far-flung geopolitical friction.

Embrace Advanced Visibility and Predictive Analytics

You can't manage what you can't see. With tens of thousands of parts moving at any given time, blind spots are not just inevitable; they're dangerous. End-to-end visibility has stopped being a luxury and is now a fundamental requirement for managing risk.

Modern platforms, using IoT sensors and AI, offer a real-time map of every component, whether it's on a truck, ship, or sitting in a warehouse. But it goes far beyond simple tracking.

Predictive analytics tools can digest data on weather patterns, port traffic, and geopolitical news to flag potential disruptions before they even happen. This gives leaders a chance to reroute shipments or activate a backup plan, turning a potential crisis into a manageable hiccup.

Instead of getting a panicked call about a delayed container, you get an alert that a storm is brewing near a critical shipping lane. That’s the difference between being a victim of the disruption and being in control of your response.

Foster Strategic Partnerships Over Transactional Relationships

The old playbook of treating suppliers like interchangeable vendors and squeezing them for every last penny is obsolete. In today's volatile world, resilience is built on collaboration, not confrontation.

Switching to a strategic partnership model creates a far more robust and adaptive network. This looks like:

- Shared Risk and Reward: Working with key Tier 1 partners to co-invest in buffer stock or share the costs of qualifying a secondary supplier.

- Data Transparency: Opening secure channels to share demand forecasts and production schedules, helping suppliers plan better and anticipate your needs.

- Joint Problem-Solving: Tackling challenges together, whether it’s a logistics snag or a quality issue, to improve the entire value stream.

When suppliers feel like true partners, they’re far more likely to prioritize your orders during a shortage or offer creative solutions when things go sideways.

Stress-Test Your Network with Proactive Planning

Finally, a resilient automotive supply chain has to be battle-tested. You wouldn't send firefighters into a blaze without a drill, and the same logic applies here. You have to practice for disruptions.

Digital twins—virtual replicas of your entire physical supply chain—are incredibly powerful for this. They let you run "what-if" scenarios without any real-world consequences. What happens if a key port shuts down for two weeks? What’s the bottom-line impact of a 25% tariff on a specific component?

These simulations expose hidden vulnerabilities and help you build contingency plans that actually work. By pressure-testing your response in a virtual world, you ensure your team is ready to act decisively when a real crisis hits.

Gaining a Strategic Edge with 3PLs and Contract Manufacturers

In a world of constant disruption, the leanest automotive supply chain isn't always the strongest. Building real resilience often means looking beyond your own four walls and forming strategic alliances. This is exactly where specialized partners like Third-Party Logistics (3PL) providers and contract manufacturers come into play.

Think of these partners as a strategic extension of an OEM or Tier 1 supplier's team. They act as a critical buffer against volatility, bringing specialized infrastructure, technology, and expertise to the table without forcing you into massive capital investments. By outsourcing vital but non-core functions, companies can get back to focusing on what they do best—design, engineering, and final assembly.

The Power of Outsourced Expertise

A dedicated 3PL or contract manufacturer isn't just another vendor on a spreadsheet; they are an integrated operational hub. Their entire business is built around one thing: executing specific supply chain functions with absolute precision and efficiency. They bring a level of focus and process discipline that’s tough to replicate in-house, especially when you're juggling a dozen other priorities.

This kind of partnership fundamentally de-risks operations and introduces a level of flexibility that's hard to achieve otherwise. Instead of sinking millions into a new warehouse or assembly line to handle a temporary demand surge, you can just tap into your partner’s existing capacity. It’s a simple but powerful shift that turns a fixed cost into a variable one, making your whole operation more agile.

By leaning on a partner's established systems and trained workforce, companies can scale production up or down with incredible speed. This agility is a massive competitive advantage in an industry defined by fluctuating consumer demand and unpredictable production schedules.

Core Services That Drive Real Value

These partners offer a whole suite of services designed to solve very specific pain points within the automotive supply chain. Their capabilities go far beyond just storing pallets; they integrate directly into the manufacturing process to improve material flow and slash waste.

Here are a few key value-added services they typically provide:

- Warehousing and Inventory Management: They offer secure, strategically located facilities to hold buffer stock or manage inbound components. This immediately reduces congestion at the main plant.

- Kitting and Sequencing: This is a game-changer. They assemble specific kits of parts for a particular vehicle build and deliver them in the exact sequence needed on the line—the very definition of Just-in-Sequence manufacturing.

- Sub-Assembly: Partners can handle light manufacturing or pre-assembly tasks, like combining smaller components into a larger module. This frees up valuable space and labor on the OEM's primary assembly line.

- Quality Control and Inspection: They can conduct rigorous inspections, sorting, and even rework on incoming parts to ensure they meet strict quality standards before they ever reach the assembly floor. This prevents incredibly costly line stoppages.

When you engage with an expert partner, these complex logistical tasks become a seamless, managed service. It’s not just about improving efficiency; it's about injecting a whole new layer of resilience into your entire system. Of course, these benefits only materialize when you find the right ally; choosing the right 3PL partner for your specific needs is a critical first step.

Ultimately, the decision to work with a 3PL or contract manufacturer is a strategic one. It's about recognizing that you don't have to be the best at every single link in the chain. By entrusting key functions to specialists, automotive leaders can build a more robust, adaptable, and cost-effective operation that's ready for whatever the future holds.

Future Trends Reshaping Automotive Logistics

The automotive supply chain is staring down the barrel of another massive transformation. This time, it’s a perfect storm of digital tech, intense sustainability pressures, and a redrawing of the global production map. The playbook that got us through the last ten years? It’s quickly becoming a historical document. Future success will depend entirely on how well we anticipate and adapt to the forces changing how cars are designed, built, and handled over their entire lives.

One of the biggest game-changers is the emergence of the Software-Defined Vehicle (SDV). We're entering an era where software and electronics are just as fundamental as the engine or the frame. This shift demands a completely different logistics mindset, where managing digital components and over-the-air updates is every bit as critical as moving physical parts from point A to B.

The Rise of Intelligent and Sustainable Operations

Artificial intelligence and machine learning are finally graduating from theory to the factory floor. These technologies are being put to work to build supply chains that are more predictive and autonomous. AI algorithms, for example, can now chew through real-time data to forecast demand with frightening accuracy, while autonomous mobile robots (AMRs) are completely changing the game in warehouses by handling repetitive tasks like picking and sorting.

At the same time, sustainability has moved from a "nice-to-have" CSR bullet point to a core operational requirement. The conversation has gone far beyond just tailpipe emissions; it’s now about the entire circular economy, which brings a whole new set of logistical headaches.

The next frontier of complexity in the automotive supply chain isn't just about managing inbound parts; it's about building an efficient, scalable, and compliant reverse logistics network for end-of-life components, especially EV batteries.

To get a better handle on what's coming, it’s worth exploring the future of reverse logistics. We're talking about everything from tracking carbon footprints deep into the supply chain to setting up massive collection and recycling programs for enormous battery packs.

A Shifting Global Production Map

All of this is happening against a backdrop of seismic shifts in where cars are actually being built and sold. Global production is expected to blow past 96 million units by 2030, with most of that growth coming from China and the Global South.

Meanwhile, the EV adoption story is playing out very differently across the globe. Battery electric vehicle (BEV) penetration is on track to hit 50-55% in Europe and China by 2030. North America, however, is lagging far behind at 20-30%. This growing divide means the one-size-fits-all supply chain is dead. What comes next will be a highly regionalized network, fine-tuned to the specific demands of each local market.

Frequently Asked Questions

It's natural to have questions when you're trying to get a handle on the automotive supply chain. It's a massive, intricate system, after all. Let's break down a few of the most common ones that come up.

What Is The Difference Between Tier 1, Tier 2, And Tier 3 Suppliers?

Think of it like a pyramid with the car manufacturer, or OEM (Original Equipment Manufacturer), at the very top.

Tier 1 suppliers are the direct partners to the OEM. They deliver fully assembled systems—think complete seating units, dashboards, or transmissions—right to the assembly line.

Tier 2 suppliers make the parts that go into those systems. They're supplying the seat foam to the Tier 1 seat manufacturer or the individual gears for the transmission.

Tier 3 suppliers are at the base, providing the raw or refined materials. This is where the steel, plastic resins, and textiles come from.

It's a deeply interconnected web. A small hiccup with a Tier 3 supplier in one part of the world can ripple all the way up and bring a multi-billion dollar assembly plant to a grinding halt.

Why Is The Automotive Supply Chain So Vulnerable To Disruptions?

The system is built for peak efficiency, but that same design makes it fragile. The vulnerability really boils down to three things: its global scale, a "just-in-time" philosophy, and long lead times.

Being spread across the globe makes it susceptible to everything from geopolitical tensions and sudden trade policy shifts to natural disasters. At the same time, the industry’s reliance on Just-in-Time (JIT) manufacturing means there’s almost no buffer. Parts arrive exactly when they're needed, so there's no stockpile to absorb a delay.

If a single component goes missing, the entire production line can shut down. Now, with the push toward EVs, we're seeing new choke points emerge around battery materials, which are concentrated in just a handful of countries. It's a whole new layer of risk.

How Does A 3PL Partner Help Mitigate Supply Chain Risks?

This is where a specialized Third-Party Logistics (3PL) partner becomes so valuable. They introduce flexibility, deep industry knowledge, and ready-to-go infrastructure right where you need it.

For instance, they can take over complex inbound logistics like kitting and sequencing, making sure the right parts arrive at the assembly line in the correct order, at the perfect time. Their warehousing networks also offer a practical way to hold strategic buffer stock, giving you a cushion against unexpected delays.

Beyond that, a good 3PL has mastered the complexities of customs, transportation routes, and regulatory compliance, helping you sidestep trade headaches. They also bring technology to the table, offering the end-to-end visibility you need to see problems before they escalate.

The global automotive logistics market, valued at €82,668.6 million after a recent downturn, is forecasted to grow by 1.8% in the coming year, reflecting cautious resilience. This growth highlights the increasing reliance on logistics expertise to navigate a complex global landscape. Read more about the global automotive supplier study.

This steady recovery isn't just a number; it shows how vital expert logistics and supply chain management have become for the industry's stability and future.

Is your supply chain prepared for the next disruption? Wolverine Assemblies, LLC provides the specialized kitting, sequencing, warehousing, and light assembly services you need to build resilience and efficiency. Stabilize your operations and de-risk your programs with a trusted Midwest partner. Discover how Wolverine Assemblies can strengthen your supply chain.

Subscribe to our weekly newsletter

.png)